Economics is a very large subject. This chapter will only survey those principles that seem to come up most often in political discussions. One can think of politics and economics in America as two sides of the same coin. Our politics is mostly about how we divide the excess wealth we produce and our economics is about how we ration the scarcities. This chapter will touch on some critical economic concepts, highlight our key economists and conclude with essential data that must be memorized.

Economic Principles[]

What follows is a summary of key economic principles, each however, has much more depth than presented. A complete study of each principle is time well spent.

The Law of Supply and Demand[]

The Law of Demand states that the higher the price of a product, the less of it people would be able and willing buy. The Law of Supply states that the higher the price at which the good can be sold, the more of it producers will supply. The key to all this is getting the signal right between producers and consumers. Hayek (see below) argued that only a free-market price, the product of millions of decisions by individuals, each pursuing her own agenda, could ever allow for efficient matching of supply and demand. Central planning by government, no matter how well it might start, could ever self-correct adequately. Be sure to understand understand both of these concepts as they are the most fundamental part of economics. Read Wikipedia on Supply and Demand for vocabulary and a more detailed discussion

There is No Free Lunch[]

Everything is always a tradeoff. Even that free lunch someone offers you comes with an opportunity cost- all the other things you could have done with that time. You might profit from something, but it isn't free.

People Respond to Incentives[]

You get less of what you tax; you get more of what you subsidize. Also known as "supply-side" economics...

Economic Growth[]

Optimal economic growth depends upon efficient allocation of resources.[1] This is most efficiently done in free markets with its optimal match of supply and demand. Any government action, be it by taxation or regulation, can only degrade economic growth. The graph below is pretty much all you need to argue Republican economics. Go to [www.heritage.org/index/ Heritage.org] to read about how the Index of Economic Freedom is calculated. Economic freedom promotes a virtuous cycle where more prosperity creates more freedom. Free markets create free people. Carry copies of the graph around with you. Every time a Democrat suggests yet another way to impose government on the economy give them a copy. If they’re “Green”, include the graph correlating GDP to environmental indicators.

Government Intervention[]

Free markets continuously make goods and services faster, better and cheaper. If government does something, you can only get one of the three.

The Trabant[]

In 1957, the communist East German government planned a People’s Car called the Trabant. Originally planned as a three-wheeled motorcycle, the motorcycle engine was kept on for the car. It was a two-cycle engine that burned an oil-gas mixture, producing a smoky, polluting exhaust. The car was produced for 30 years without much change, assembled on an inefficient labor-intensive production line. It could take years to get the car after it was ordered and so owners took exceptional care of them, the average car lasting 28 years. Many improvements were suggested over the years but were rejected by the government as too expensive. With the fall of the Soviet Union in 1990, Trabants became well known in West Germany as their owners abandoned them after driving to the West, where they bought second-hand Mercedes Benz’s.

Wealth is created. It is not a zero-sum game.[]

Throughout the 1960s it became fashionable to predict general doom for western civilization for any number of reasons. It was common to hear extreme predictions of industrial collapse in a few years due to shortages of raw materials, followed by the fall of western civilisation.

In 1968, Paul Ehrlich published a book called The Population Bomb that predicted that “hundreds of millions” of people would starve to death by the 1990’s and that “India couldn't possibly feed two hundred million more people by 1980". In 1969 Ehrlich published the statement that he would bet “even money that England would not exist in 2000”, Julian Simon, an economist, dismissed the latter claim as silly but bet Ehrlich that not only would there be no shortages, but the price of commodities would decrease. In 1980, Ehrlich picked 5 metals, with the payoff date in 1990. From 1980 to 1990, despite the largest growth in population in world history of 800 million people, the price of all five metals dropped and Ehrlich paid Simon $576.07.

Simon subscribed to the “cornucopia” model of wealth where the ultimate resource is people, and their ingenuity could solve all problems of scarcity: when there is scarcity prices will rise. These higher prices prompt the search for solutions, which, when found, leave us better off than if the problems had never occurred, because prices will be lower and quality will be higher. This means that the economic pie can be made larger and everyone will be richer. By comparison, many Democrats subscribe to the “Malthusian catastrophe.”[2]Hi theory is that earth’s resources are finite and will eventually run out and the “manna from heaven” or “zero-sum” theory, where if you have more, you must have taken some of my share.[3]

The Tragedy of the Commons[]

It is an old observation that when an individual can gather all of the benefits of something to himself, while placing all of the costs on the group, he will pay no attention to long term consequences. “Tragedy of the Commons” is a metaphor that refers to the parish land in Medieval England that could be used by commoners for grazing. It was in the interest of each herder to get as many of his animals grazing for as long as possible without concern for any adverse consequences such as overgrazing, mud hole production in wet conditions etc. Examples of present day moral hazard include overfishing of the oceans and emission of pollutants into the atmosphere. Libertarians and conservative tend to solve the problem by assigning property rights. Socialists tend to respond with government regulations.

Moral Hazard[]

This is a term from the insurance industry that refers to the concept that if you know that the bad consequences of risky behavior will be borne not just by you, but shared by a group, you will be more likely to engage in that risky behavior. For example, if you have a no-deductible fire insurance policy on your house, you will be less diligent in clearing the brush around it. If you have car insurance, you will be more likely to drive in bad weather. Moral Hazard comes up in politics when Democrats want society to bear the costs of an individual’s poor decisions. For example, are single mothers more likely to have another out-of-wedlock child if their welfare benefits will thereby increase? Will individuals take better care of their health if they know that they will be responsible for their own medical bills? The argument becomes difficult when an individual suffers through no fault of her own, for example, victims of a catastrophe. Should the children of that poor welfare mother pay the price of her decisions?

The Pantheon of Economic Gods[]

Republican Economists[]

Adam Smith[]

Wealth of Nations (1776) “by directing (his) industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention… By pursuing his own interest the individual frequently promotes that of society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good. A moral philosopher, Smith is known as the father of classical economics, and develops the majority of modern free-market theory. Key terms: Invisible Hand, Free-Market, Greed.

David Ricardo[]

On the Principles of Political Economy and Taxation (1817) the theory of comparative advantage states that even if a country could produce everything more efficiently than another country, it would reap gains from specializing in what it was best at producing and trading with other nations. This is a core argument against unions trying to stop outsourcing of work to other nations. Key term: Comparative Advantage.

Frederich Hayek[]

The Road To Serfdom (1944) argued that, in centrally-planned economies, a select group of individuals must determine the distribution of resources, but that these planners will never be able to carry out this allocation reliably. Only through the price mechanism of free markets can this be done efficiently. Hayek also noted that central economic planning lead towards totalitarianism because the central authority would have to be endowed with coercive social powers to enforce its mandates. Associated with prices especially in free-markets.

Milton Friedman[]

Free to Choose (1980) popularized in a television series on PBs, of all places, his explanations of free markets and capitalism had as great impact on the general population as his research had on economics. An economic libertarian, Friedman’s insights into laissez-faire[4] capitalism provided the intellectual underpinnings of the Reagan Revolution. Key term: laissez-faire.

Democrat Economists[]

Karl Marx[]

Communist Manifesto (1848) “The history of all hitherto existing society is the history of class struggles” in which capitalism would be replaced by radical socialism in which we would all live in communes. While he has some good insights into capitalism, more important is that his ideas would be the center of the political conflicts of the 20th century. Key terms: Communism, Marxism (the pure economic theory), Class Warfare.

John Maynard Keynes[]

General Theory of Employment, Interest and Money (1936) Argues that interventionist government should uses its financial tools to increase taxes in boom times so as to use the savings to mitigate recessions. In practice increase taxes in boom times and immediately spent the money. Keynesian Economics are the cornerstone of Democrat macroeconomics.

John Kenneth Galbraith[]

The Affluent Society (1958), The Industrial State (1967), a leading proponent of socialist economics in the 1950’s and 1960’s, he argued that economic power would continue to concentrate in the US so that the future would see a triumvirate of Big Business, Labor and Government. He felt that modern advertising created an unhealthy consumerism and that this artificial affluence caused the neglect of more important things such as schools and parks. He felt that “higher minds” in government would do a better selection for people than they could do for themselves.

Essential Numbers[]

Population and GDPs[]

| Size of the world’s economy | $48 trillion |

| Size of American economy | $13 trillion |

| American government income | $2.4 trillion |

Rank by Population Rank Country Population 1 China 1.3 billion 2 India 1.2 billion 3 United States 301 million 4 Indonesia 231 million 5 Brazil 187 million

Rank by Economy (GDP) Rank Country GDP 1 United States $13.2 trillion 2 Japan $4.4 trillion 3 Germany $2.9 trillion 4 China $2.6 trillion 5 Britain $2.4 trillion

US Federal Government[]

Federal Revenue[]

All numbers in 2006 dollars

- Since World War II, tax receipts have averaged around 18 percent of GDP.

- The low was in 1961 at 17% (Kennedy).

- The high was in 2000 at 21% (Clinton).

- So while federal spending has relentlessly increased, regardless of which party held Congress, it has stayed relatively inline with the size of the economy.

- Note that Social Security and Medicare now account for 35% of federal revenue.

- The top 1 percent of income earners, by household, paid 37 percent of all federal income taxes in 2003

- The bottom 50 percent paid a little over 3 percent.

- American households are sending more of their income to Washington even with the 2001 and 2003 tax cuts

- For 2006, the average household will pay $20,664, down from $22,647 in 2000 but much higher than $13,017 in 1965.

- The average American household tax burden increased steadily since 1965, rising 20 percent during the Clinton Administration.

- Today's tax burden remains higher than all administrations except for Clinton's, even with the recent tax cuts.

- The top corporate tax rate, like the top individual rate, was reduced the most under President Reagan, from 46 percent to 34 percent.

- Today, with a combined federal and state tax rate of 39 percent, it is the highest corporate tax rate in the developed world.

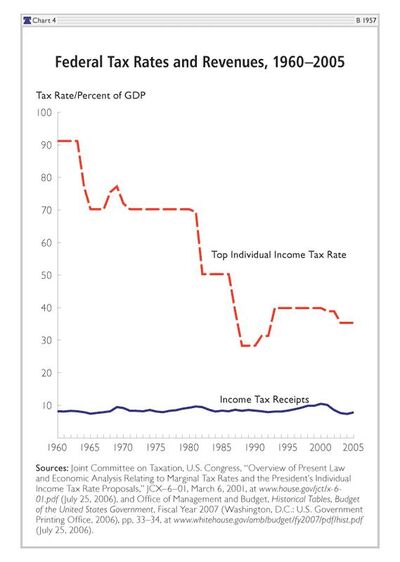

- When tax rates go down, government income goes up (bottom right).[5]

Federal Spending[]

Again, all data in 2006 dollars.

- Where the money is spent (2006):

| Entitlements | ||

| Social Security | $871 million | |

| Medicare | $343 million | |

| Medicaid | $192 million | |

| Subtotal (Entitlements) |

$1,306 million | |

| Interest on Debt | $220 million | |

| Defense Spending | $536 million | |

| Total | $2,062 million |

- This accounts for 76% of the $2.7 trillion dollars spent.

- Despite the War in Iraq, military spending is modest relative to the size of the economy.

- Anti-poverty spending has increased 39% to $397 million dollars in the Bush presidency and now represents 16% of the federal budget.[6]

Exercises[]

Discuss the following statements:

The modern conservative is engaged in one of man's oldest exercises in moral philosophy; that is, the search for a superior moral justification for selfishness.

--John Kenneth GalbraithTrickle-down theory - the less than elegant metaphor that if one feeds the horse enough oats, some will pass through to the road for the sparrows.

--John Kenneth GalbraithThe gap in our economy is between what we have and what we think we ought to have – that is a moral problem, not an economic one.

--Paul HeyneEvery time we’ve lowered the tax rates across the board, on employment, on saving, investment and risk-taking in this economy, (government) revenues went up, not down.

--Jack KempToday we have a temporary aberration called “industrial capitalism” which is inadvertently liquidating its two most important sources of capital: the natural world and properly functioning societies. No sensible capitalist would do that.

--Amory LovinsWe have to shift our emphasis from economic efficiency and materialism towards a sustainable quality of life and to healing of our society, of our people and our ecological systems.

--Janet Holmes a CourtPoverty has been created by the economic and social system that we have designed for the world. It is the institutions that we have built and feel so proud of, which created poverty in them.

--Mohammed YunisIn the model that we grew up with, governments rule physical territory in which national economies function and strong economies support hegemonic military power. In the new model, already emerging under our noses, economic decisions don’t pay much attention to national sovereignty in a world where more than half of the one hundred or two hundred largest economic entities are not countries but companies.

--Amory LovinsThe most important single central fact about a free market is that no exchange takes place unless both parties benefit.

--Milton FriedmanIn today's knowledge-based economy, what you earn depends on what you learn. Jobs in the information technology sector, for example, pay 85 percent more than the private sector average.

--Bill ClintonThe blunt truth about the politics of climate change is that no country will want to sacrifice its economy in order to meet this challenge, but all economies know that the only sensible long term way of developing is to do it on a sustainable basis.

--Tony BlairSocialism failed because it couldn't tell the economic truth; capitalism may fail because it couldn't tell the ecological truth.

--Lester Brown Fortune Brainstorm Conference, 2006

Footnotes[]

- ↑ Economics is the study of the distribution of scarce resources

- ↑ Malthus predicted that, since population was growing so fast, farmers would eventually be the richest people and the rest of the earth would starve. He didn't realize that technology would prevent this.

- ↑ This is the basis for mercantilism

- ↑ Idea government should not interfere in the economy

- ↑ See Understanding Income Taxes

- ↑ Heritage Foundation